Net external debt rises to 178.6 billion, but retrieves in a percentage of GDP

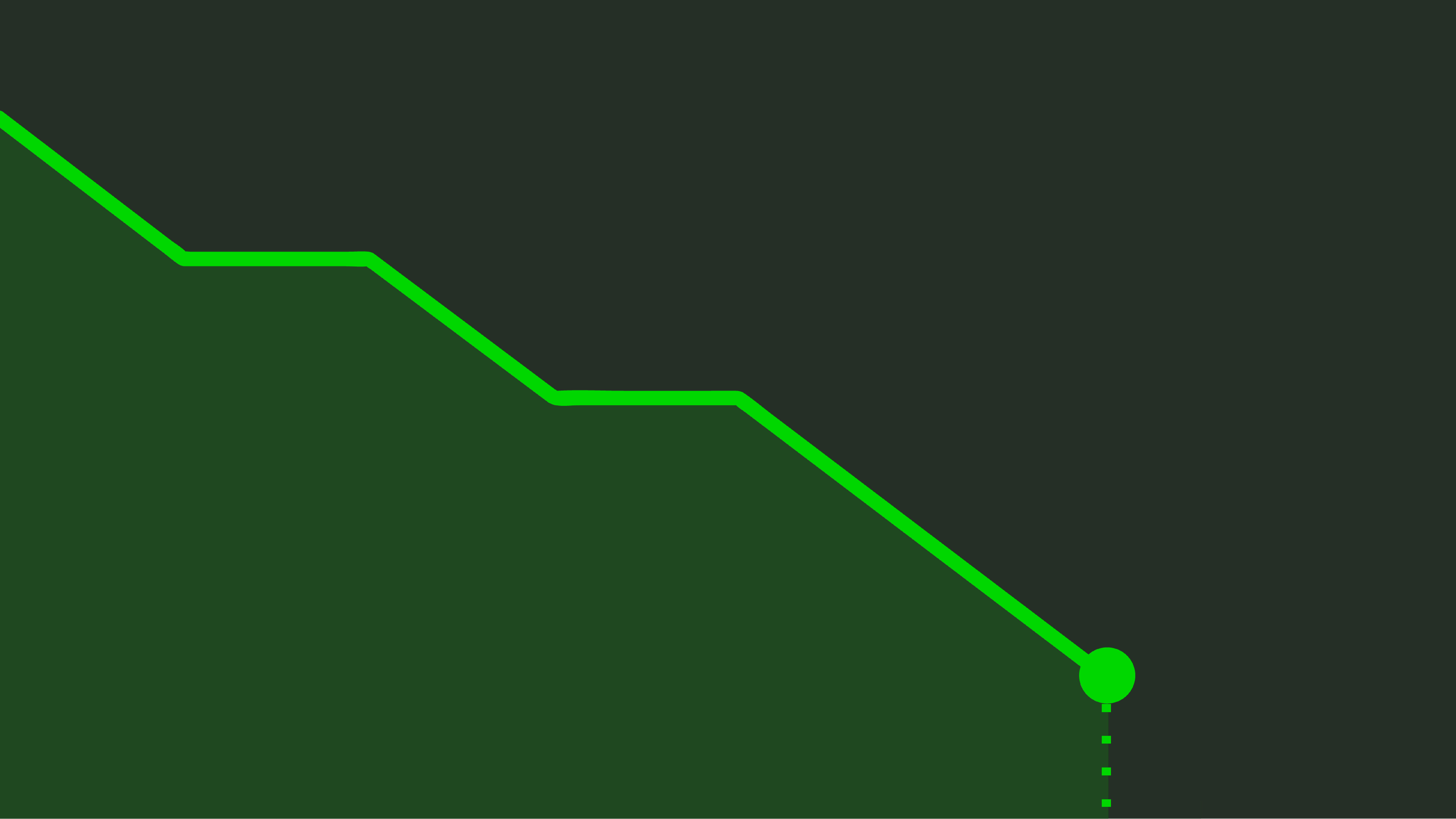

The Portuguese external debt increased 3.3 billion euros in 2017, reaching 178.6 billion euros. In spite of this growth, the results means there is a retrieve in GDP percentage points.

By the end of 2017, the Portuguese net external debt increased stood at 178.6 billion euros. This amount represents 92.9% of the Gross Domestic Product (GDP), according to this Wednesday’s data from the Bank of Portugal (BdP).

According to the central bank, net external debt increased 3.3 billion euros in comparison to 2016, “largely due to the valuation of the Portuguese public debt”.

In spite of this nominal increase, net external debt in GDP percentage retrieved 1.7 percentage points between the end of 2016 and the end of 2017, going from 94.6% to 92.9% of GDP, “given that the increase in GDP more than offset the nominal increase in debt”.

According to the data disclosed, Portugal’s International Investment Position (IIP) in the end of 2017 was negative by 204.1 billion euros, an amount that corresponds to -106.2% of GDP, which is comparable to the -196.8 billion euros’ IIP from the end of 2016, totaling -106.3% of GDP.

According to the banking regulator, the price and exchange variations had a negative impact on IIP of -7.6 billion euros and -2.1 billion euros, respectively.

In the case of price changes, “they were due to the valuation of government debt securities and shares of Portuguese enterprises held by nonresidents, which increases the value of Portugal’s external liabilities”. As for exchange rate changes, “they were mostly due to the appreciation of the euro against the US dollar”.

According to BdP, transactions had a positive contribution to the 3.1 billion euros’ evolution of Portugal’s International Investment Position.