REN is in the market to issue 300 million euros in ten-year debt

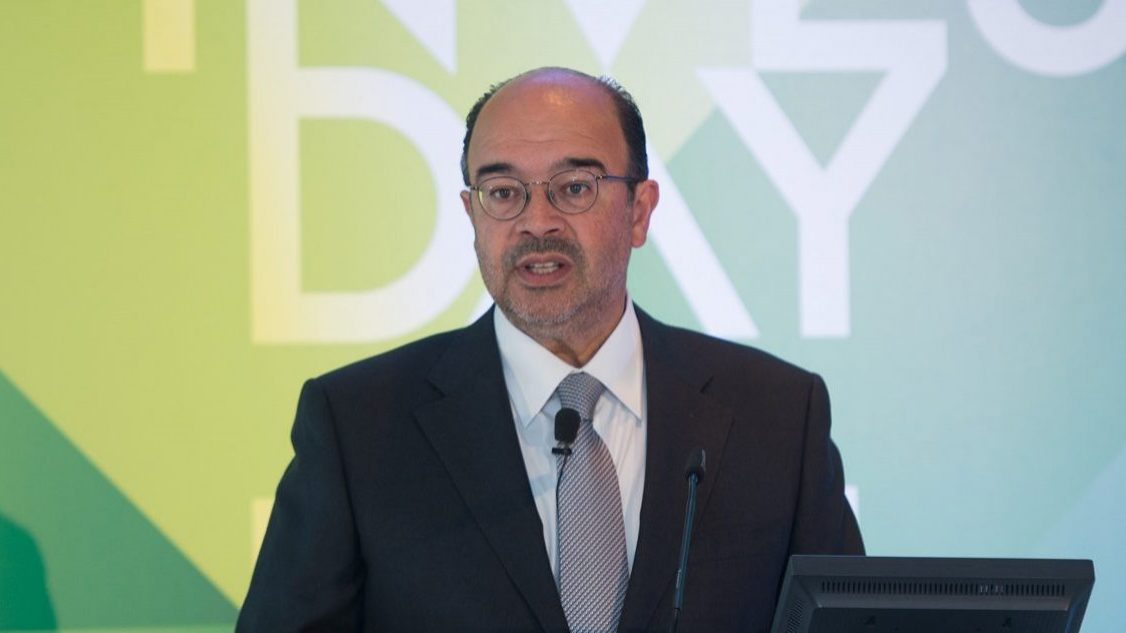

The company headed by Rodrigo Costa will go on a roadshow. It wants to attract investors to a ten-year debt issuance, aiming to obtain 300 million euros.

REN will go on a roadshow aiming to attract investors for a long term debt issuance. According to Bloomberg, the company headed by Rodrigo Costa aims to issue ten year bonds in an operation that hopes to get 300 million euros.

According to the news agency, the operation to assess investors’ appetite for debt securities will move forward next Monday, January 8. Barclays, Deutsche Bank, HSBC, BPI, BCP and Haitong will go on the roadshow and place the issuance.

In this operation, the company wants to place securities with a ten-year maturity, according to Bloomberg, which cited close sources to the process that preferred to remain unidentified. The goal is to raise 300 million euros.

ECO has tried to confirm this information with the company that manages the energy networks in Portugal, but, so far, the listed company hasn’t provided any clarifications.

REN has quality ratings from the main international rating agencies. It has a Baa3 rating from Moody’s, a BBB- from S&P and BBB from Fitch.