Investors already believe Portugal is less risky than Italy

On the day that Fitch should remove Portugal from the "junk" status, Portuguese bonds are negotiating at a lower rate than the one demanded by the market to purchase Italian bonds.

The Portuguese debt is already less risky for investors than the Italian debt, given the good momentum Portugal is going through in the markets, as a result of the expectation that Fitch will remove Portugal from the “junk” status this Friday.

This takes place after the Portuguese ten-year bonds started trading at a lower rate than the one demanded by investors to purchase Italian bonds for the same maturity, something the market had not seen since the end of 2009, a time when Portugal moved to the international spotlights because of the instability of the Euro Area sovereign debts.

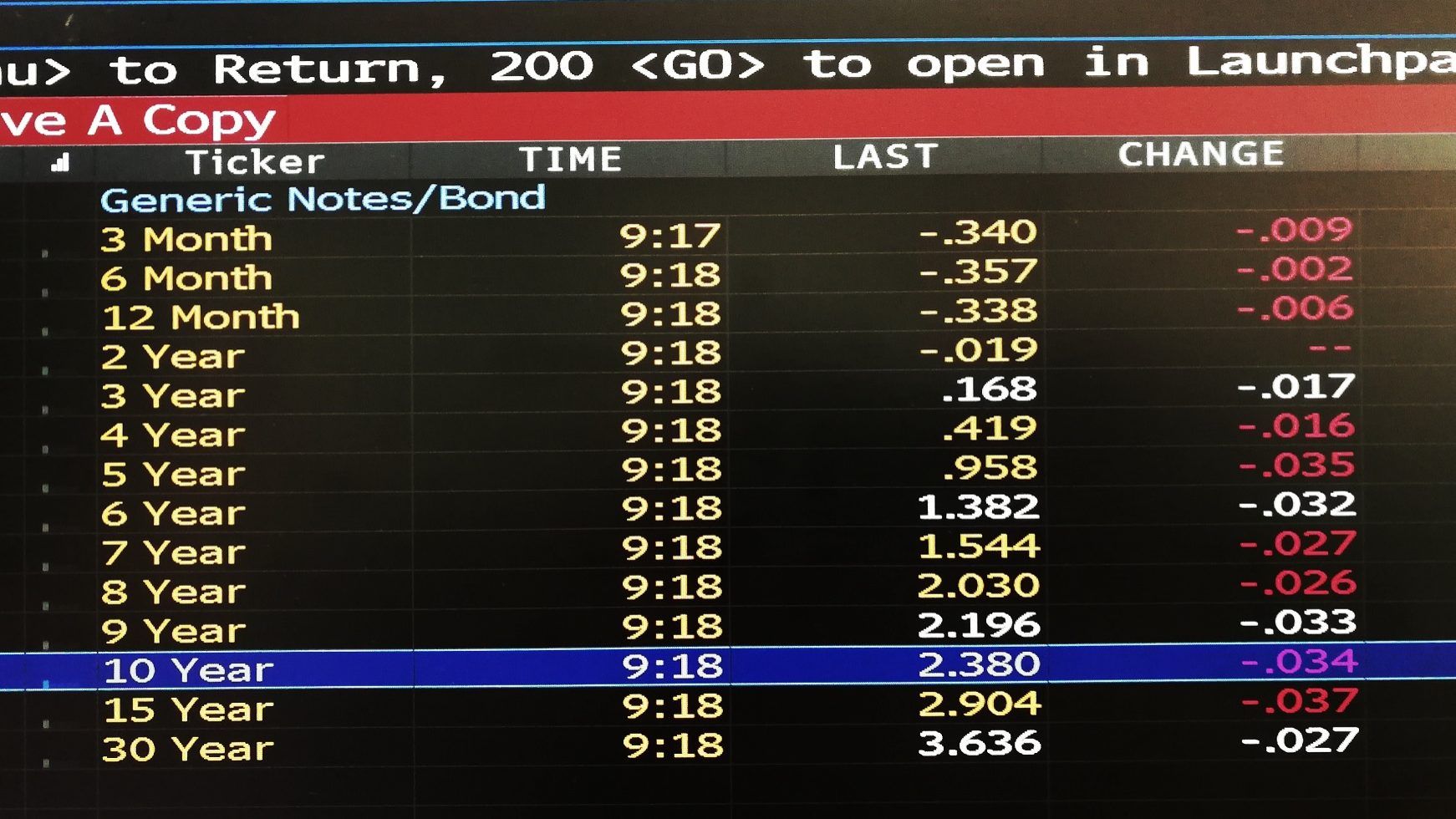

The implied yield for the Portuguese ten-year debt fell this Friday by over four basis points to 1.774%. It is comparable to the 1.781% rate of the Italian debt. The difference between both rates is now favorable to Portugal, which means Portugal is already perceived as less risky for the market than Italy.

Ten-year interest decreased in Portugal

This fact gains more relevance if we take into consideration that the rating given by rating agencies puts Italy in a higher threshold than Portugal. Which seems contradictory, since the rating evaluates countries’ risk profile.

In the case of Moody’s and Fitch, for example, there are two levels separating Italy and Portugal’s ratings, giving advantages to the first. Concerning Standard & Poor’s, after improving the Portuguese rating in September, removing the country from the “speculative investment” threshold, the difference between the Portuguese and Italian rating fades to just one level.

This means that investors trust Portugal more than they trust Italy, contrary to rating agencies, which give Portugal a smaller ability to comply with its financial obligations.

Analysts from Rabobank attempt to give an explanation for the phenomena based on an Irish example. Irish bonds are also showing a good performance in comparison to Belgium and France’s bonds, despite the fact that Ireland has a rating that stands two levels below its reference peers. Analysts explain that such movement in the debt market was a result of the fact that Ireland has a “relatively small” amount of tradable debt in the market in comparison to the total amount of debt, which is a “also a characteristic of Portugal”.

In a scenario that acknowledges an improvement of the Portuguese rating by Fitch as “likely”, Rabobank saw the Portuguese ten-year debt rates going towards the Italian rates. The market anticipated this and already considers Portugal’s debt is less risky than the Italian debt.