Portugal already has 25% of bonds with negative rates

ECB has been a good friend of the Portuguese debt. Over 26 billion euros in national bonds are negotiating with negative interests, decreasing the financing costs and the public treasury.

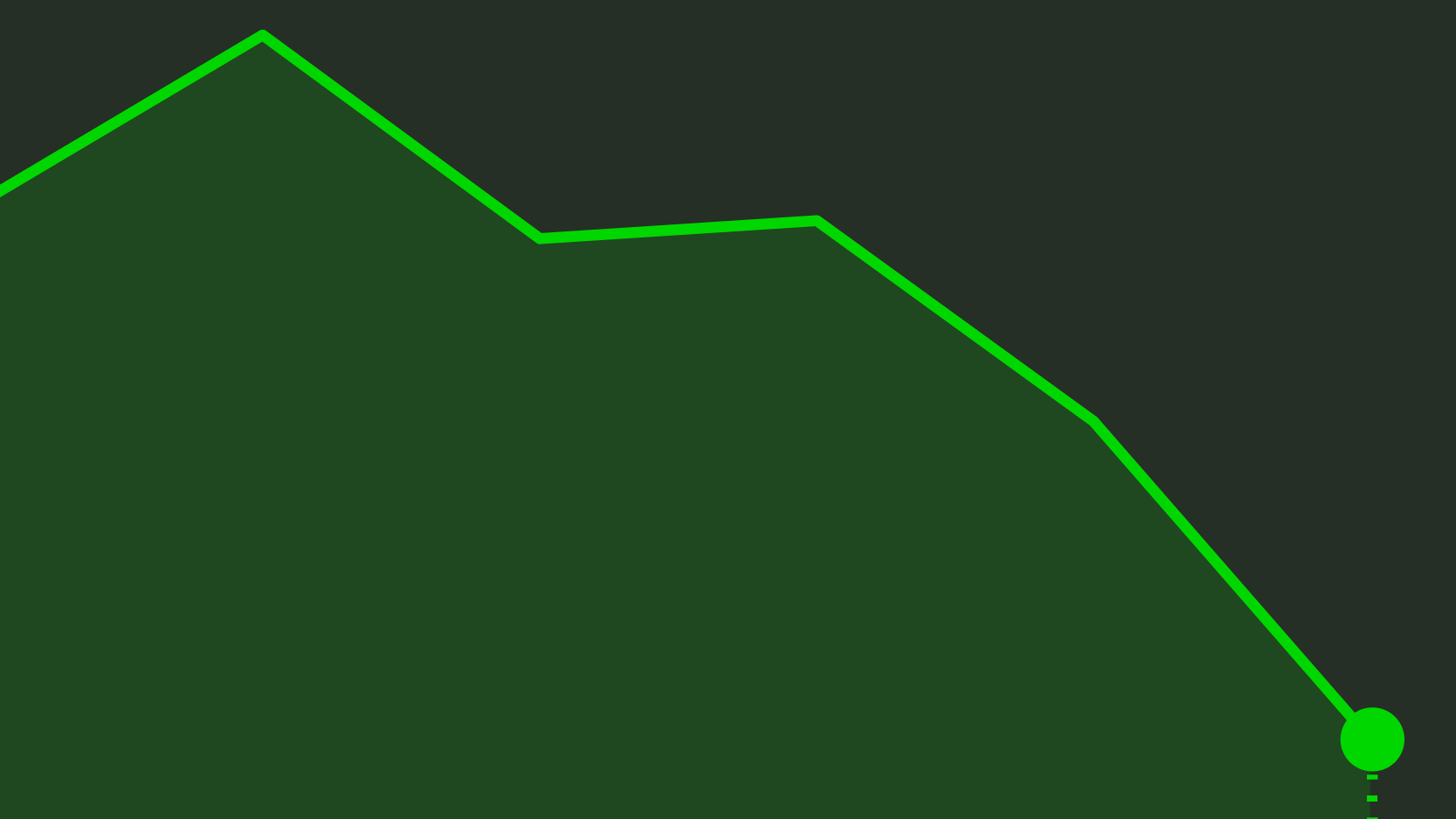

There is no doubt that Portugal is still benefiting from a good momentum in the debt market: more than one quarter of the Portuguese debt has negative interest rates, totaling 26.6 billion euros, according to data given to ECO by the online platform Tradeweb. The European Central Bank (ECB) has contributed decisively to the this scenario, which has allowed the Portuguese Republic to decrease its financing costs.

There is a total of 116.8 billion euros in Treasury bonds that the Government has already issued in the primary market and that investors can negotiate between them in the secondary market. Around 22.8% of these bonds are already being transacted at negative rates, according to Tradeweb. This means that investors are purchasing these debt securities for a much higher amount than what they will see reimbursed in the end of the maturity, which gives out a sense of trust about the country’s ability to pay its debt.

Only last week, another Treasury bond line had its interest rate fall to negative grounds. It was the yield on three-year debt, currently negotiating at -0.078% and which has joined other lines with lower maturities at negative rates: two years, 12 months, six months and three months.

What ends up happening in practice is that investors are accepting to acquire these securities for 105 euros, for example, when they know that they will receive at least 100 if they maintain the security until the end of the maturity. Hence the negative return rate of the asset.

Even so, this doesn’t mean that investors will lose. Firstly, the Treasury bonds pay a coupon every year, assuring an early income to those who hold them. Then, these titles may maintain their upward tendency that has been seen this year. In that case, an investor can buy a 105 euros’ bond in hopes of selling it for 106 euros or more, earning capital gains from that operation. This scenario is not unreasonable, since the markets keep favoring the Portuguese debt, in anticipation of Fitch’s decision to remove Portugal from the “junk” category.