Portuguese Government protects depositors and pressures Novo Banco’s bondholders

The Portuguese Government increased the protection of banking depositors, in a time when funds have an offer to sell Novo Banco's bonds. The pressure is on.

The Portuguese Government wants to protect all depositors in case there is a resolution or liquidation in any bank. The information was disclosed by the secretary of state Assistant and of Finance Ricardo Mourinho Félix, in a meeting with journalists this Monday. The timing of this measure is not innocent: ECO knows it is connected to Novo Banco’s situation — bond exchange for cash in order to be sold to Lone Star.

According to Mourinho Félix, the goal of this new legislation is to give a larger protection to bigger depositors of a bank than what they currently benefit from, the Portuguese newspapers Expresso and Jornal de Negócios stated.

When a bank goes through a liquidation, or a resolution, only deposits from private individuals and small and medium enterprises (SME) up to 100 thousand euros are fully covered. From this amount onward, SME and private individuals benefit from a larger protection than the remaining depositors, shareholders and bondholders — the same is to say they are the last to suffer losses.

The Portuguese executive’s intention is to broaden this protection to larger depositors, making these bondholders’ assets, which are riskier in comparison to privates and SME, the first to be called in case there is a resolution of the bank. This initiative was proposed by the Bank of Portugal, as Expresso previously revealed.

This positive differentiation of large depositors already takes place in countries like Italy and Germany. Mourinho Felix justified the timing of this operation with a certain “calmness” in the financial system, but ECO knows the Government wants this measure to be quickly enforced because of the situation with Novo Banco.

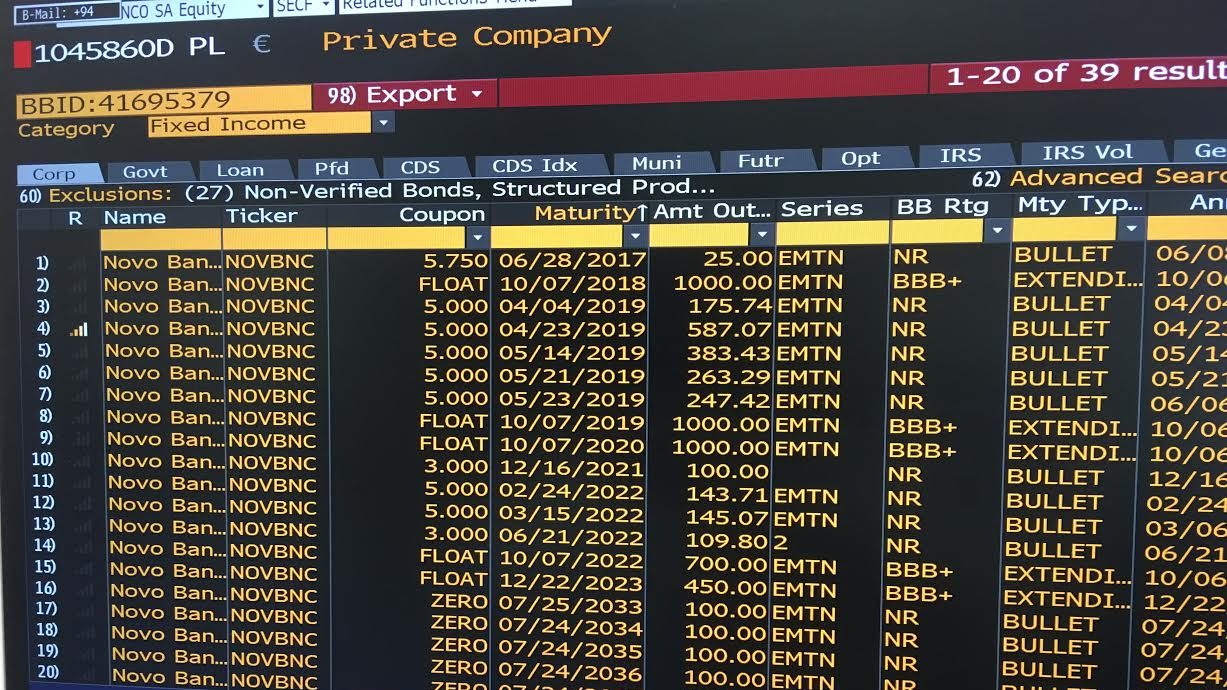

In order for the bank to be sold, senior bondholders must accept trading their assets for deposits, taking on losses. In case this operation is not concluded and the sale falls through, Novo Banco could suffer a liquidation or a resolution, in a process headed by the European resolution authority. The Executive is playing ahead, looking for a way to make companies and other large depositors take less chances in case the sale does fail, a source explained ECO.

Simultaneously, this measure works as a way to pressure senior bondholders who are confronted with the exchange offer. If they refuse, they know they, as bondholders, are not as protected as larger depositors, unlike what currently happens. On the contrary, if they do accept the offer, they will become deposit holders and know they are more protected.