BCP keeps falling. The market writes a 500 million euros’ invoice

BCP's shares fell for seven days in a row, to later recover... and then devalue again. Amendments and fears concerning the bank's "adventure" in Poland question its value.

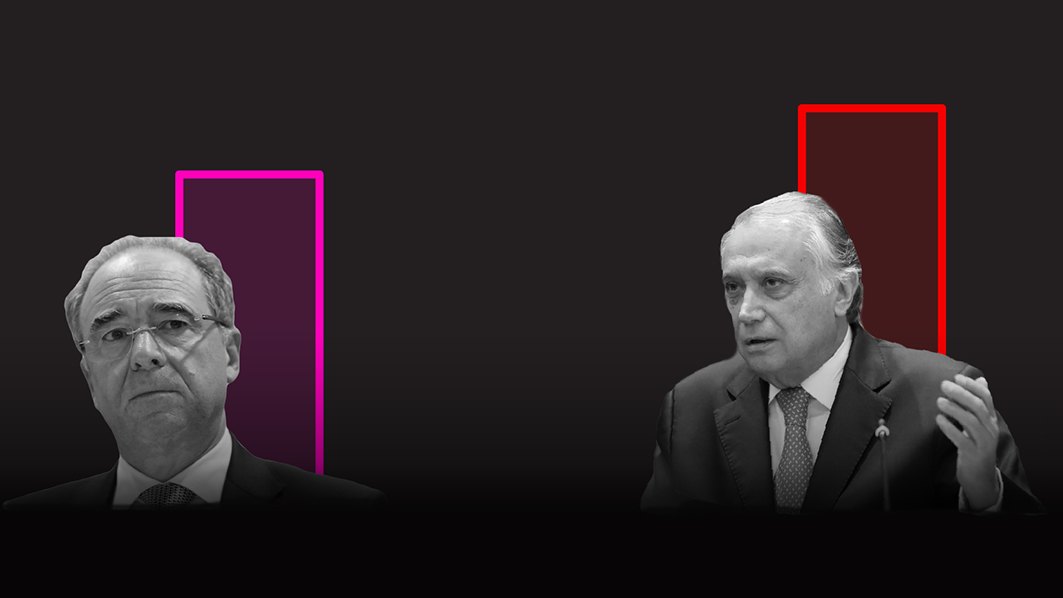

BCP keeps falling. The bank headed by Nuno Amado fell for seven says in a row, the longest cycle of plunges in a year, to then recover… and take another dive. These expressive decreases have “cost” more than 500 million euros to the institution’s market value in movement of correction, but also of fears from investors concerning the financial impact of the possible purchase of the Polish unit of Deutsche Bank in BCP’s accounts.

This month alone, BCP has lost almost 300 million euros, but the invoice almost doubles if the current market value of the bank is compared to last month’s, when it reached 28 cents: it shrunk by 571 million euros to 3,362 million euros. It decreased 14% in a little over a month, being that in August alone, it heads the decreases in the PSI-20 by retreating a little over 8%. Titles are decreasing 1.77% to 22.18 cents, moving towards the smallest closing value in the past three months.

Albino Oliveira, manager in Patris Investments, believes the “fall in BCP’s quoting could reflect a correction, after a strong increase since its minimum in February 2017”. Yet, he believes that this is also occurring because there is a “harder context for the share markets in the Euro Area (Euro Stoxx falls 6.50% since its peak in May), and in which the European banking sector has also been presenting a consolidation trend since its May peaks”.

But that is not the only reason. BCP’s interest in the Polish unit of Deutsche Bank could be raising concerns among investors “concerning the impact of the purchase in the bank’s accounts”, since the institution will invest money “in a time when its financial stabilization phase is not yet over”, Paulo Rosa, senior trader in Banco Carregosa, told ECO. This operation could also be a “constraint to the distribution of dividends starting in 2018/2019, as it had been signaled when the capital increase took place“, states Pedro Lino from Dif Broker.