Single Social Tax: the alternative for employers could be the Labor Compensation Fund

If the Single Social Tax decrease is not approved in Parliament - as it may indeed happen -, employers will seek alternatives. Funds which pay part of dismissal's compensations may be on the table.

It seems the Single Social Tax decrease (TSU) for companies paying minimum wage to their employees will not move forward on Parliament this Wednesday, judging by the stand taken by the leftists (the Left Block – BE – and the Portuguese Communist Party – PCP) and the Portuguese Social Democratic Party (PSD). For now, employers do not have a plan B, but there are some alternative measures they may come to consider.

ECO was able to discover that one of the possible alternatives may concern dismissal funds. The Portuguese Labor Compensation Fund (Fundo de Compensação do Trabalho – FCT) makes companies pay 0.925% of the basic wage and seniority payments of employees hired from October 2013 onwards; an additional 0.075% discount goes to the Labor Compensation Fund.

The agreement for the minimum wage increase – and a decrease in the TSU for companies who bear the 27 euros increase in wages – also considers evaluating a “review of the rules and functioning of the Labor Compensation Fund”.

Employers believe they have made many contributions to the Fund which were never reclaimed and, therefore, they believe companies could suspend the discounts or receive the amounts they have previously paid, for example.

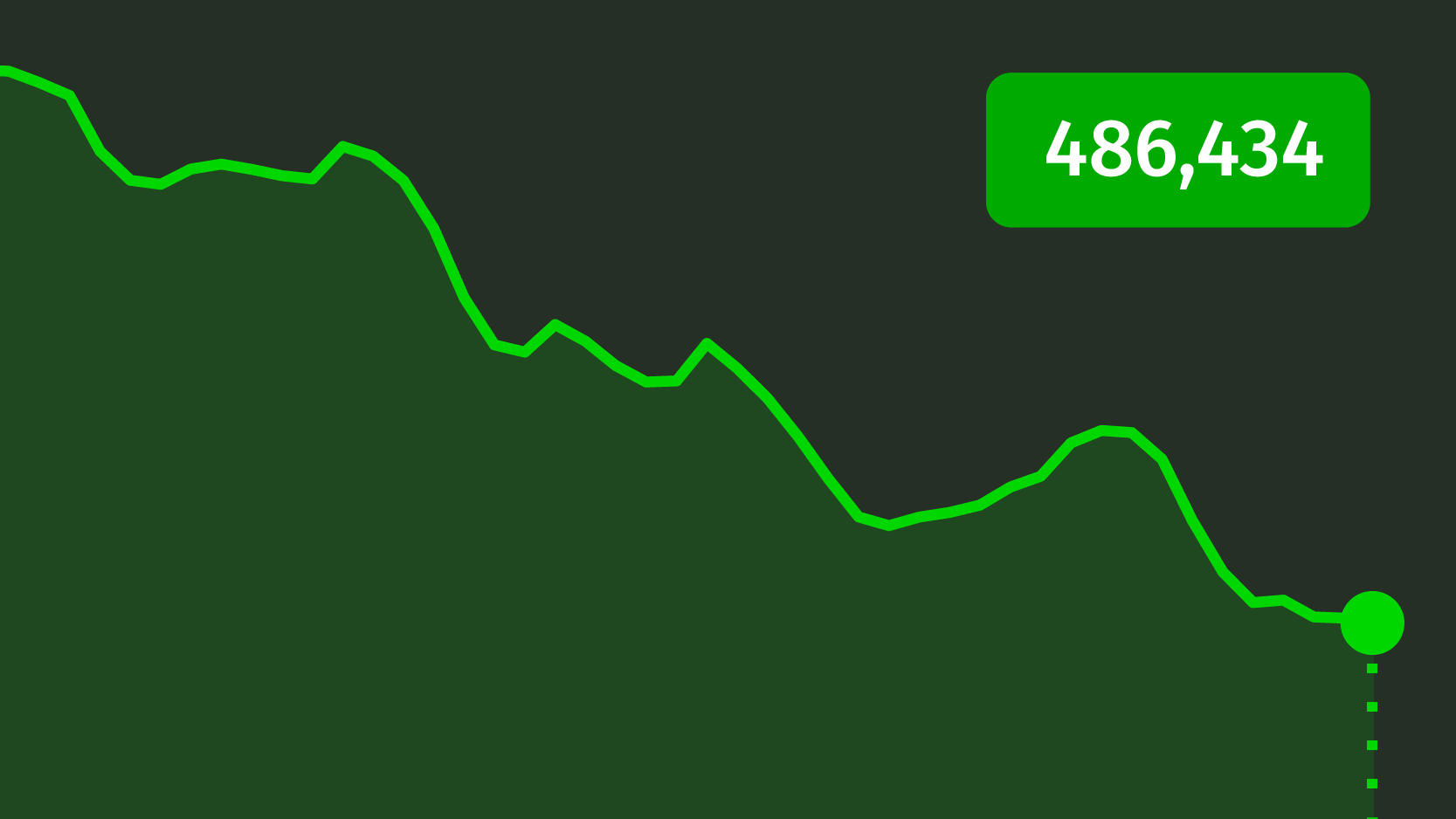

Last December, the Fund’s market value was 106.3 million euros, although in September its debt was close to six million euros.

The Portuguese Communist Party (PCP) and the Left Block (BE) advocated for a decrease of the tax companies must pay in advance to the state according to the profit they predict making (PEC), for example, but they do believe there is a quid pro quo concerning minimum wage. The CDS (Democratic and Social Centre Party – People’s Party) also presented alternative measures, namely the 0.75 percentage points’ decrease of the TSU for companies paying a monthly minimum wage to employees, which would mean extending the temporary measure still in force.