Boost in business’ risk pressures credit to companies

The new credit granted to companies in the first eight months of 2017 reached an historical minimum, according to the Bank of Portugal. In total, companies borrowed less than 20 billion from banks.

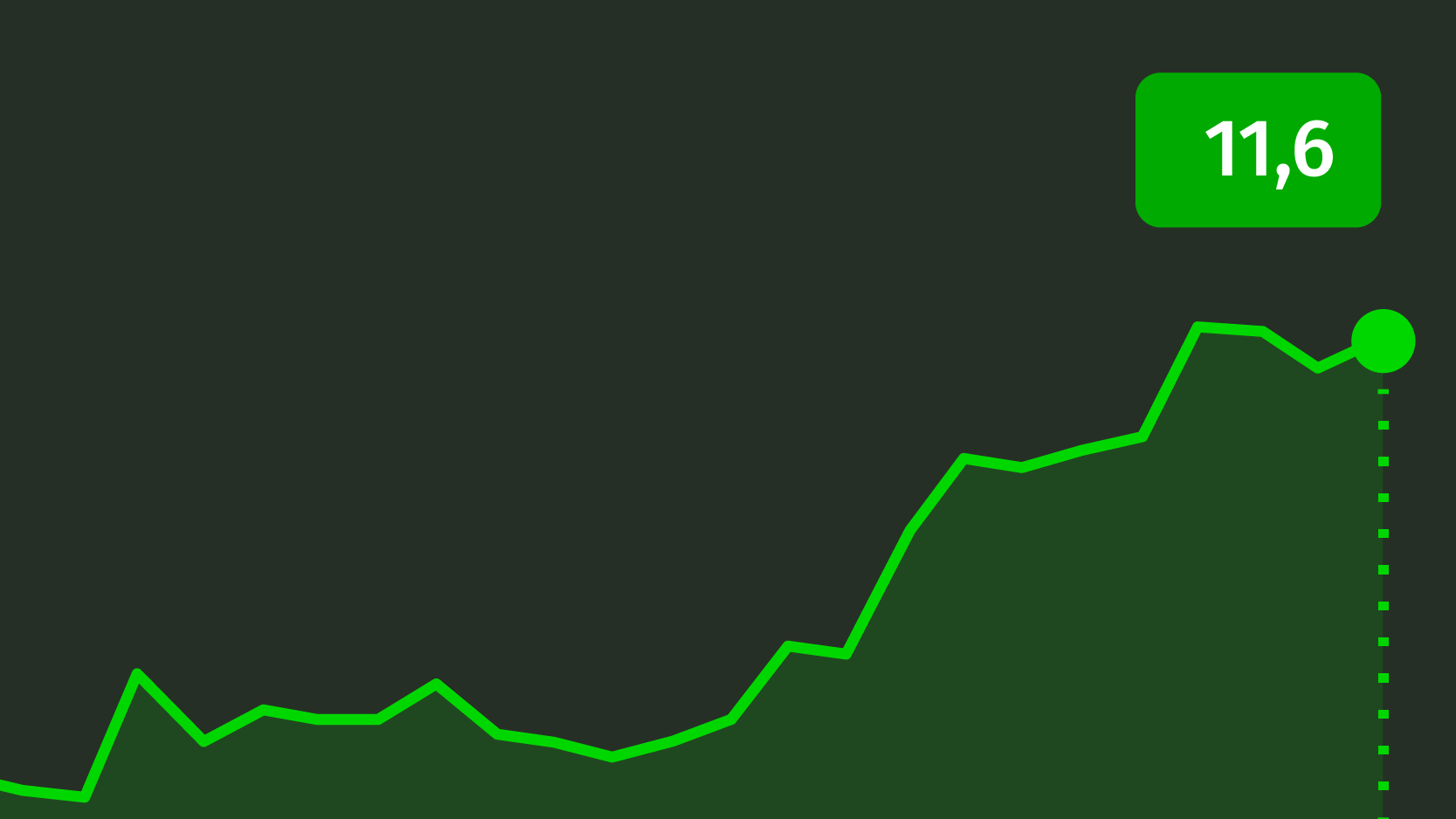

On Tuesday, based on their statistical database going back to 2003, the Bank of Portugal communicated that the new lending operations to the business segment decreased in August to its lowest documented value: in the first eight months of 2016, the overall amount of new loans to companies was 19.9 billion euros, comparing to 22 billion in 2015 and almost 29 billion in 2014. This decreasing tendency is seen across the different corporate segments. In the first eight months of 2016, small and medium-sized enterprises borrowed 11.7 billion euros from banks, while larger companies borrowed 8.2 billion – 5% and 15% less, comparing to the same period.

Credit given to companies over the last five years

This year’s values in credit granted to companies emphasize the downturn verified in the segment throughout the years. A trend that contradicts what happens with private individuals, since in the first eight months of 2016, new loans to families grew 27% compared to the same period – which added up to 7.3 billion euros. This tendency is what upholds the injection of liquidity in the market that the European Central Bank desires, sustained by the historically low interest rates.

Analysts consider these data reveal the deteriorating conditions from the supply side — translating in a greater level of both requirements and caution from banks in terms of risk assessment –, but also reveal a decline in credit demand.