Jerónimo Martins “celebrates” in Slovakia with eight stores, but risks another fine in Poland

The company will open 50 supermarkets by the end of 2026 in Slovakia, where it entered six months ago. From Poland comes a poisoned gift: competitors accuse Biedronka of deceiving customers.

Six months after Biedronka officially launched its operations in Slovakia, with the opening of a distribution centre 40 kilometres from Bratislava and its first store in Miloslavov, Jerónimo Martins (JM) now has eight supermarkets operating in the country, where it decided to internationalise one of the group’s food retail brands for the first time.

However, it received a “poisoned gift” from the neighbouring Poland: a new accusation from the competition authority, this time targeting the lack of transparency in price information.

It was precisely on the eve of celebrating its first six months of operation in the Slovak market, on 5 September, that the owner of Pingo Doce opened its eighth commercial space in the town of Revúca.

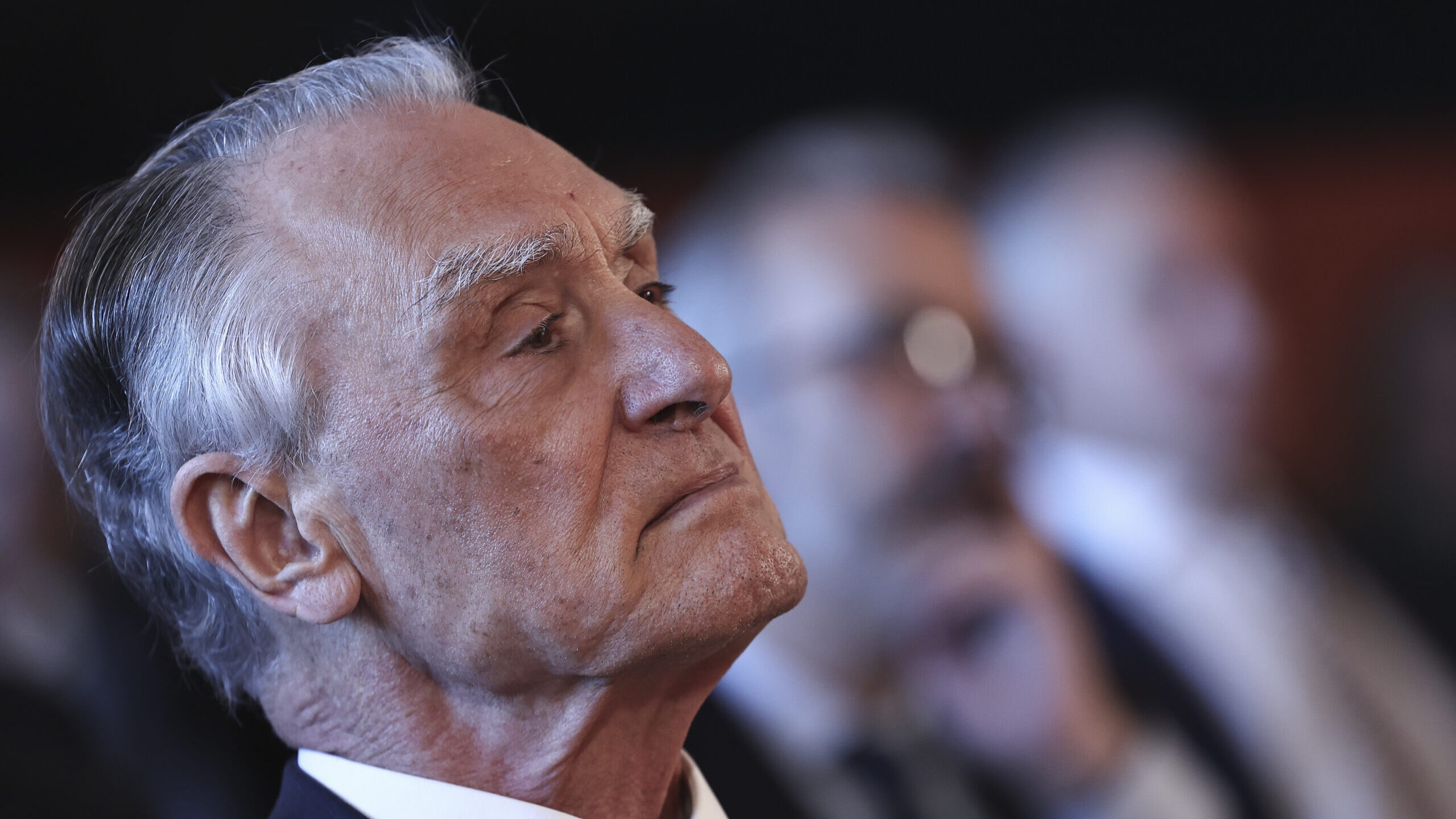

The other stores are located in Miloslavov, Považská Bystrica, Senica, Zvolen (2), Liptovský Mikuláš and Nové Zámky. The group led by Pedro Soares dos Santos has set itself the goal of “opening at least 50 stores in Slovakia by the end of 2026”.

When questioned by ECO, an official source at JM stressed that “it is still too early to take stock and provide data on the financial performance of Biedronka Slovakia, as it only began operating in this country a few months ago”.

In the first half of 2025, when it made a profit of 269 million (+6.6%), operating almost exclusively in the Polish market, Biedronka achieved sales of 12.4 billion euros, up 7.1% on the same period last year, with EBITDA up 9%.

“We are pleased that our commitment to offering Slovak products in our stores has been recognised in this country. An independent study recently revealed that, among all foreign food retail chains operating in Slovakia, Biedronka is the one with the highest share of Slovak food products available on its shelves, with a value above the average recorded in this market”, the group points out.

After a year and a half of preparation, the expansion of the ‘ladybird’ brand into food retail in the neighbouring market, which borders four other countries (Hungary, the Czech Republic, Austria and Ukraine), kicked off with some Portuguese products in shopping trolleys, such as wine, olive oil and coffee, around 300 employees and an investment of around €75 million by December, as estimated by the CEO of Biedronka Slovakia, Maciej Lukowski.

On the day it made its debut in Slovakian food retail, on 5 March, the JM leader acknowledged the context of “uncertainty” and “much greater instability for decision-making than existed” when he ventured into Poland with the Biedronka brand, which is now completing three decades, or when he entered Colombia with Ara a dozen years ago, which recently approved a deal that will allow it to reach 1,500 stores in Latin America.

Even so, Pedro Soares dos Santos is confident that “growth will be in Central Europe and further east”.

It is also in these regions that the Portuguese multinational is expanding with the Hebe health and beauty chain, which closed the first half of this year with a total of 382 stores in Poland, four in the Czech Republic and two in Slovakia, while continuing to “look for opportunities” in these new regions.

Regarding a possible link between these retail operations in Slovakia, JM replied to ECO that Hebe “is a business with characteristics that are totally different from food distribution, with very residual synergies, especially at the back-office level”.

Price information in the sights of the Polish regulator

Poland continues to be the group’s growth engine, with Biedronka’s 3,720 stores, employing 81,000 people, contributing to more than 70% of the company’s total revenue last year. It was in this territory, where it is the leader in food retail, and coinciding with the six-month anniversary in the neighbouring country, that the Competition and Consumer Protection Authority (UOKiK) opened a new case against the company for practising “unclear pricing”.

Accused of “violating the collective interests of consumers”, JM’s Polish subsidiary risks paying a fine of up to 10% of its turnover in the country, which last year amounted to €23.6 billion.

At the same time, three directors have been indicted and may each be fined €470,000 on the grounds that “the appearance and content of the labels were not the result of individual actions by employees of a specific store, but are determined centrally at the company’s headquarters”.

In a publication on 9 September, the agency explains that it launched an investigation following reports from consumers describing irregularities in Biedronka’s promotional campaigns, complaining, in particular, about difficulties in identifying the correct price when purchasing items in a multiple purchase offer and the “illegible display” of information on the lowest prices charged in the 30 days prior to the discount, including the use of very small fonts.

As part of the verification of the implementation of the Omnibus Directive and this investigation into retail chains, inspectors from the Commercial Inspection Authority, which reports to the UOKiK, collected “extensive photographic documentation”, mainly of price tags and signs displaying discounts offered in-store, gathering evidence that “confirmed the irregularities” previously reported by consumers.

“When shopping, price is a key factor for consumers — some choose the cheapest products, while others consider the price-quality ratio. In both cases, they need clear information about the final price of a product in order to make an informed and rational decision. However, the labels contained misleading or illegible information for consumers”, criticises Tomasz Chróstny, president of UOKiK.

In accusing Jerónimo Martins Polska and its directors of “violating fundamental consumer rights” with regard to price information, the head of the Polish competition authority emphasises in the same statement that this decision is also “a clear signal to other market operators not to create ambiguous, overly complicated and therefore misleading price reductions”.

In response, the company says it is ready for a “constructive dialogue with the president of UOKiK to find a solution that is satisfactory to all”. In a statement sent to Reuters, it adds that “the Omnibus Directive is a relatively new legal regulation and promotional pricing practices are different in the Polish market and require harmonisation”.

This is yet another headache for the group in Poland. Less than a year ago, the Competition and Consumer Protection Tribunal (TCDC) in the same country confirmed a fine of 506 million zloty (around 118 million euros) on Biedronka for abuse of bargaining power in commercial relations with fruit and vegetable suppliers, validating seven cases of contractual advantage presented by the competition supervisor.

In Portugal, after 12 years of appealing to the courts to challenge the collection of the Food Safety Tax (TSAM), Jerónimo Martins decided to “proceed with the full payment of all amounts invoiced”.

As ECO reported first-hand, the owner of the Pingo Doce, Recheio and Hussel chains decided to settle the amount owed at the end of last year, which amounted to “around €30 million, including all invoices from 2024”.