New EU budget rules must not worsen state debt, deficit problems

EC proposed "risk-based" fiscal rules upon their resumption in 2024, suggesting a "technical path" for indebted EU countries, such as Portugal, giving them more time to reduce deficit and debt.

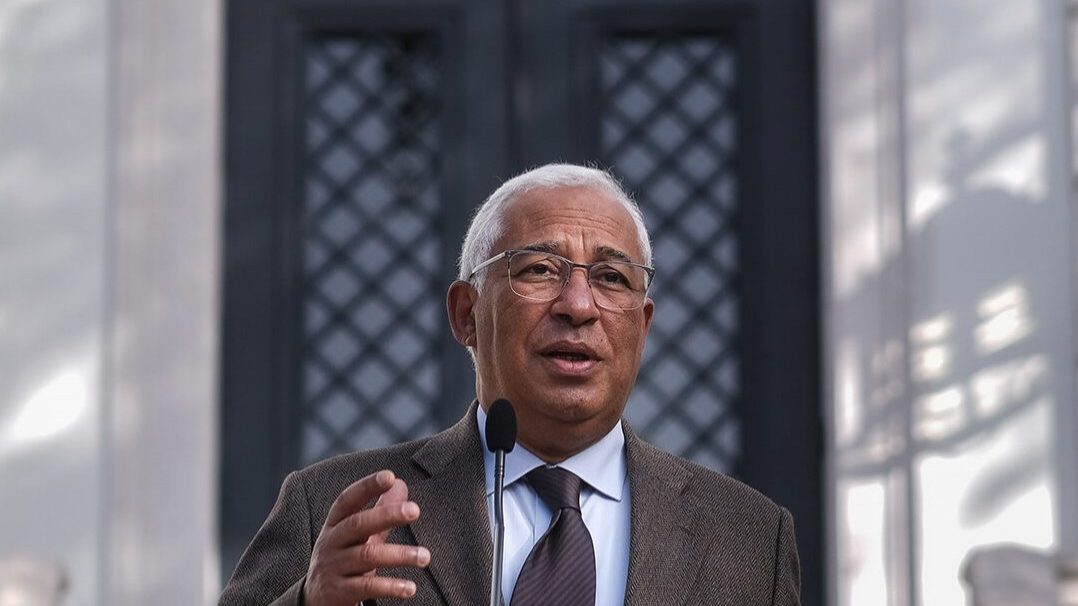

Portugal’s finance minister, Fernando Medina, said on Friday that the new budget rules being discussed in the European Union should not be a “source of problems” by aggravating the crisis at negative moments.

“Learning from the lessons of the past, that the budgetary rules have an increasingly anti-cyclical character, that the rules themselves are not, as happened in the past, a source of problem from the point of view of budgetary and financial management,” Medina said at a joint press conference in Lisbon with the European Commissioner for the Economy, Paolo Gentiloni.

For Medina, “in no case [this proposal] compromises the growth strategy of the Portuguese economy,” and said that the strongest point of the European Commission’s proposal is precisely that of “trying to avoid that the rules have a pro-cyclical nature, that in a period of crisis or low growth the rules force fiscal consolidation efforts that only aggravate the situation,” but said that work will continue.

Medina also said again, as he had already said at the end of an informal Eurogroup in late April, that even with the resumption of European Union (EU) rules in 2024 for debt and deficit, with or without a more flexible path of reduction, Portugal will have no problem in complying with them.

In April, the European Commission proposed “risk-based” fiscal rules upon their resumption in 2024, suggesting a “technical path” for indebted EU countries, such as Portugal, giving them more time to reduce deficit and debt.

A greater differentiation between EU countries is foreseen, taking into account their degree of difficulty, so that member states with a deficit greater than 3% of Gross Domestic Product (GDP) or with public debt greater than 60% of GDP will have a “technical path” defined by the European Commission.

In force for 30 years, the Stability and Growth Pact (SGP) requires member states’ public debt not to exceed 60% of GDP and imposes a deficit below the 3% threshold, but in the context of the pandemic, the escape clause was activated in March 2020 to allow member states to react to the Covid-19 crisis by temporarily suspending such requirements.

Against the backdrop of geopolitical tensions and disruption in the markets by the war in Ukraine, the temporary suspension of SGP rules was maintained for another year, until the end of 2023, with budgetary rules now expected to resume in 2024.