Public investment to rise 37% next year to 3.5% of GDP

According to a report accompanying its draft state budget for 2023, public investment next year will be 36.9% higher than in 2022.

Portugal’s government estimates that public investment next year will be 36.9% higher than this, and equivalent to 3.5% of gross domestic product, according to a report accompanying its draft state budget for 2023.

“Public investment projections for 2023 amount to 3.5 percent of GDP [Gross Domestic Product], representing an increase of 36.9 percent compared to 2022, which will allow the Portuguese economy to become more competitive and increase its potential growth,” the government states in the document.

According to the report, “it is important to highlight that public investment continues to register an evolution consistent with the degree of maturity of structural investments planned before the Covid-19 pandemic, estimated at €10,874 million, to which are added the Recovery and Resilience Plan (RRP) projects” for spending post-pandemic European Union recovery funds.

According to the report, “the RRP reinforces the crucial role of public investment, [and is] anchored in the Portugal 2030 Strategy and aims to implement a set of investments that promote the specialisation of the Portuguese economy, convergence with the European Union and the acceleration of the digital and climate transition.”

The state budget also highlights that structural investment “in 2023, will rise to around €2,262 million, representing an increase of more than €580 million compared to 2022” and that “investments in the areas of transport, health and social security, as well as environment and agriculture, will continue to make an important contribution to this evolution.”

The government on Monday submitted to parliament a 2023 budget bill that foresees economic growth of 1.3% next year, with a public sector budget deficit of 0.9% of GDP.

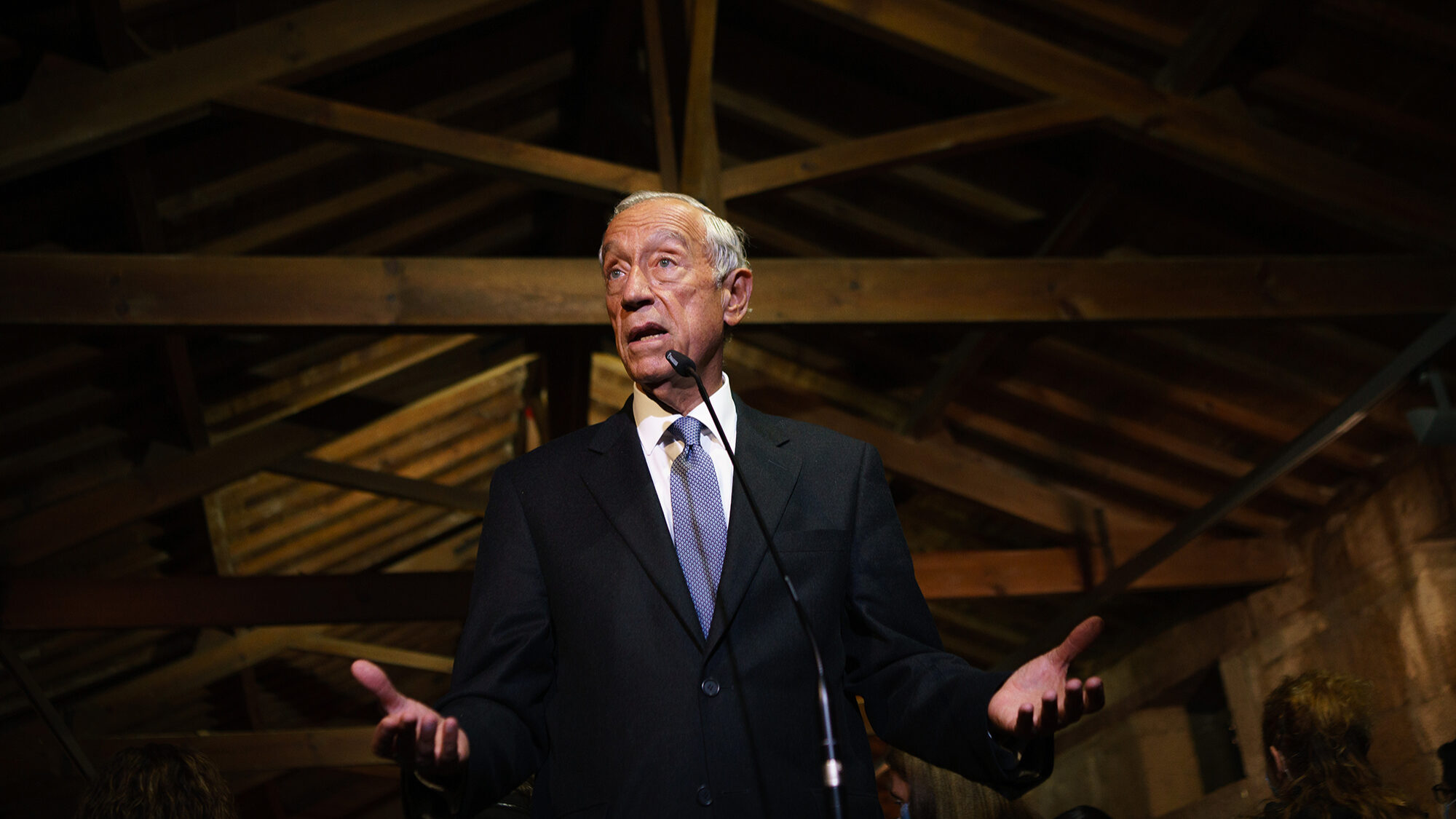

The minister of finance, Fernando Medina, said that the proposal will boost incomes and foster investment, while maintaining the commitment to sound public finances in an adverse external environment of war in Europe and escalating inflation.

The government aims to reduce net public indebtedness to 110.8% of GDP in 2023 from 115% in 2022, and projects inflation to slow to 4.0% next year from from 7.4% this.

The bill is to be given its first reading in parliament on October 26 and 27, with the final vote scheduled for November 25.