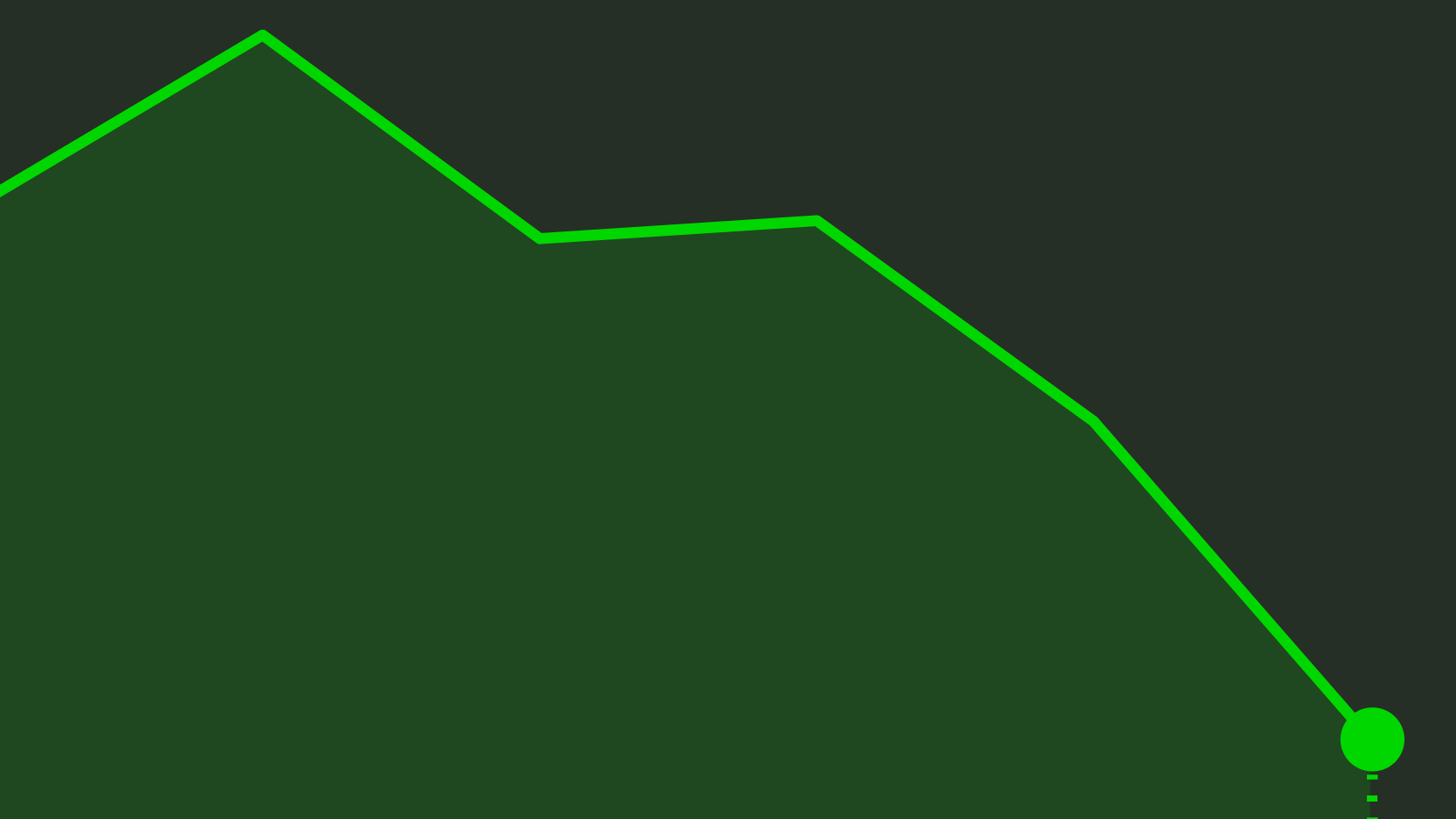

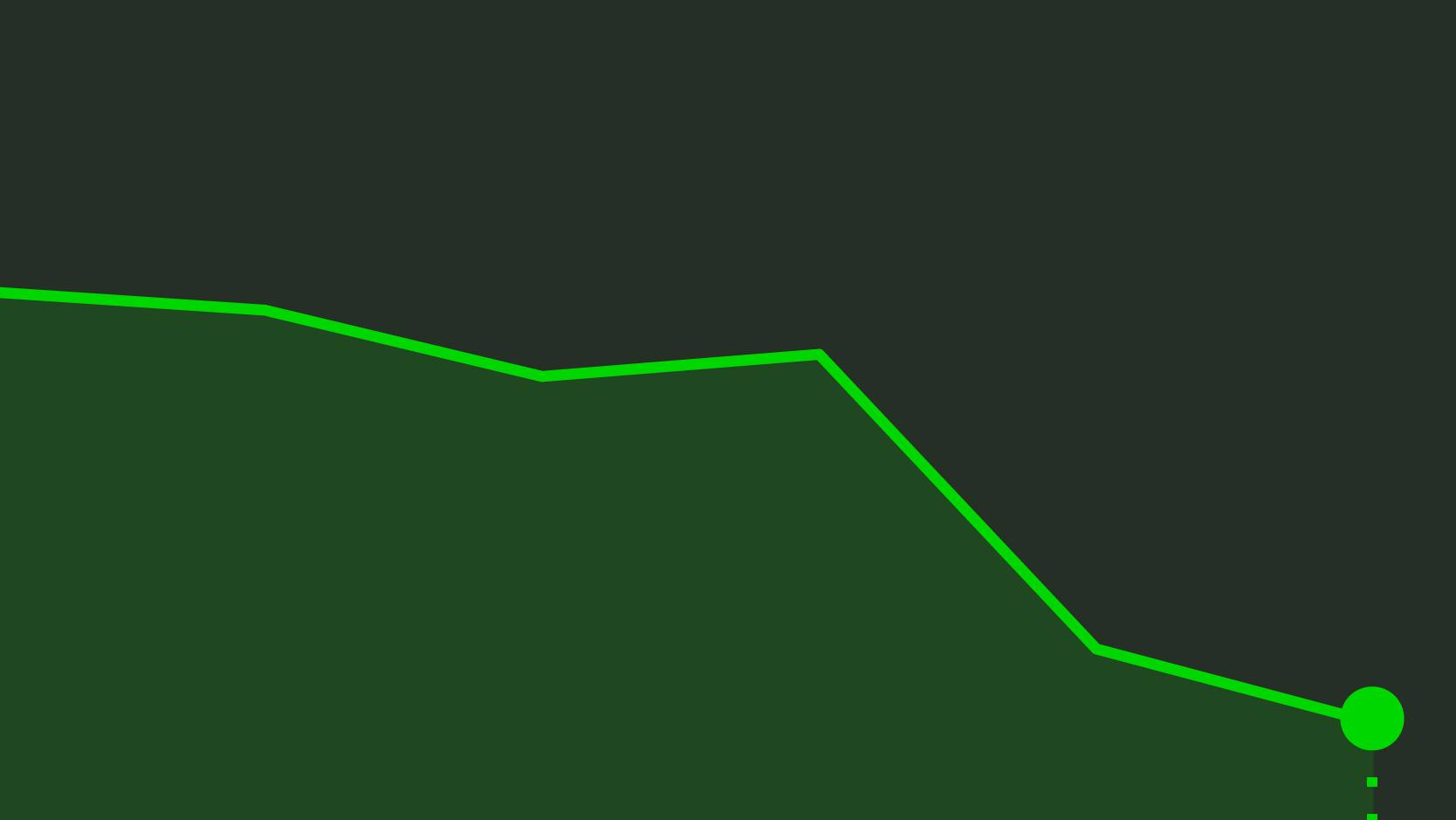

Portuguese ten-year rate in maximums of two months

Portuguese debt interests worsen, in sync with its peripheral peers, conditioned by the perspective of a debt pardon of 250 billion euros by the ECB from an Italian partisan coalition.

Portuguese debt interests are under pressure, with the ten-year rate standing at maximums of two months. The increase in yields takes place after, this Wednesday, the Italian partisan coalition intending to form a Government disclosed its intention to move forward with a debt pardon request to the European Central Bank (ECB), of 250 billion euros.

The Portuguese ten-year sovereign debt increased to 1.84%, which corresponds to the highest rate of the past two months. In Italy, the rate increases to 2.18%, reaching a maximum of three months.

The worsening of interests that is seen this Thursday follows what had been seen in the last session, when the Huffington Post Italia accessed a preliminary version of the Italian Five Star Movement and the League coalition programme which accounted for a document that foresaw a request for a 250 billion euros’ debt pardon to ECB.

Meanwhile, the coalition is said to have refused that intention, but a “Pandora Box” was opened concerning similar debt pardon requests, not only from Italy, but from countries like Portugal, for example.

The worsening in interests that has been seen in the last few days ended up affecting the debt issuance made last Wednesday. The Portuguese Debt Management Agency (IGCP) was able to place the maximum amount foreseen of 1,750 million euros in Treasury Bills, but it paid higher negative interest rates than in the previous comparable issuances.