Moody’s salutes changes in Montepio

Moody’s says the capital increase and transformation of Caixa Económica in a public limited company will reinforce the institution's capital. Yet, the volume of toxic assets continues to be a problem.

Moody’s says the capital increase and transformation of the bank in a public limited company are the changes in Caixa Económica Montepio Geral which have had a positive impact for the creditors of the institution. “It strengthens the bank’s loss absorption capacity in the face of very significant asset quality challenges”, states María Viñuela, Assistant Vice President and analyst for Moody’s, author of the agency’s Issuer Comment.

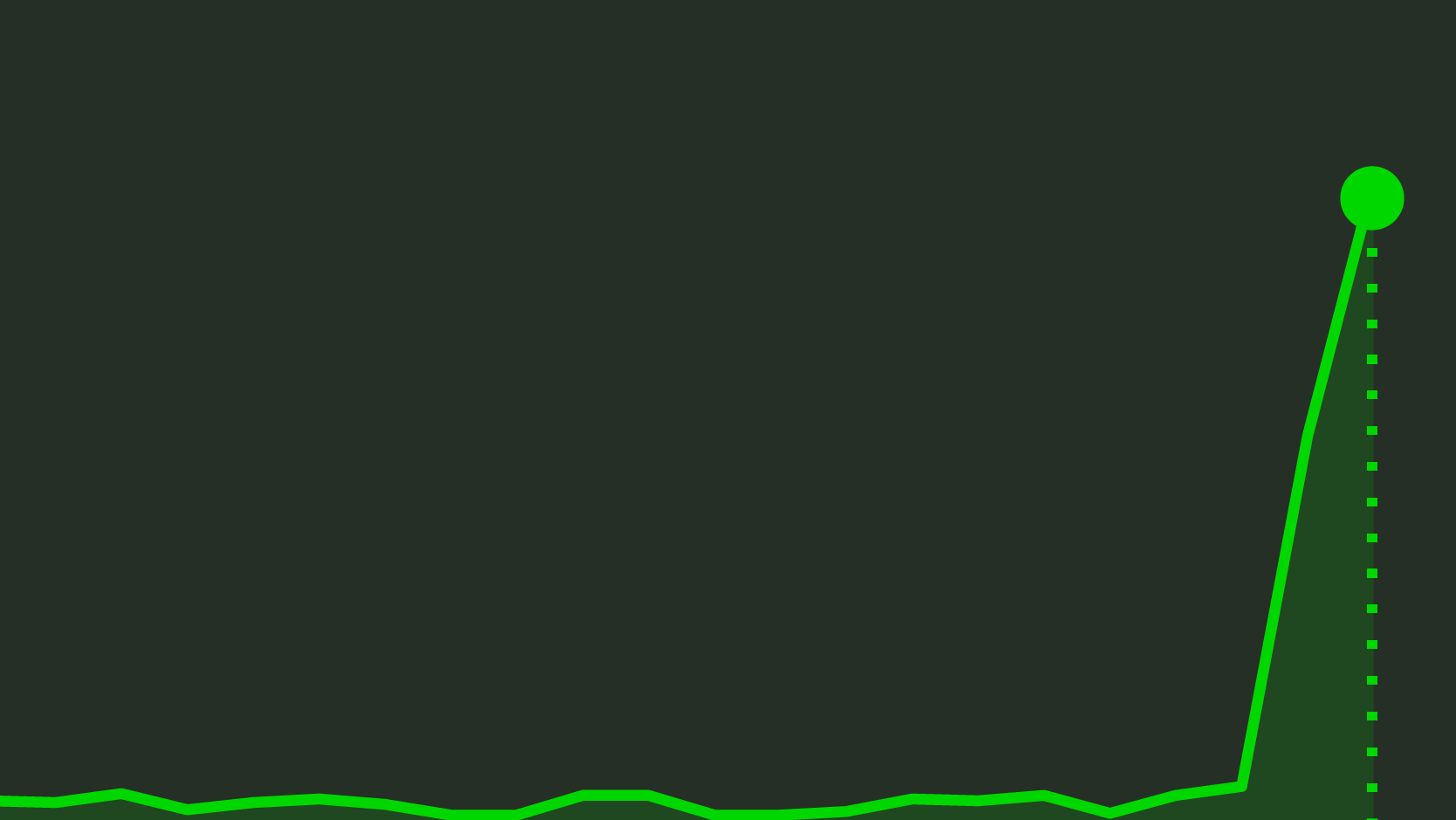

Moody’s estimates the 250 million euros’ capital increase in the bank will allow the bank to increase its financial strength ratio from 10.7% to 12.6%, “allowing it to comply with regulatory capital requirements”. More so: it brings Montepio’s ratios closer to other Portuguese bank’s ratios, whose average stood at 12% in the end of March.

On June 30, when Montepio Geral concluded the 250 million euros’ capital increase, the bank announced a takeover bid on the units it did not hold from Caixa Económica’s participation fund, in a time when it is preparing its transformation in a public limited company.

Moody’s believes the institution headed by Félix Morgado will benefit from this transformation. Firstly, it will “enable it to access capital markets in case of need”, while it was exclusively dependent on Associação Mutualista until now. Secondly, because as soon as the bank is transformed into a public limited company, Montepio will be able to adhere to the deferred tax assets (DTAs) special regime. ” This will have an estimated positive impact of 50 basis points on its phased-in CET 1 capital ratio and 120 basis points on its fully loaded CET1″, Moody’s estimates, disclosing, however, that the impact of the DTA will be limited due to the amount of toxic assets.

Currently, Moody’s gives a B3 negative rating to Caixa Económica Montepio Geral.