Portugal is almost free from the IMF’s debt surcharge

The spread paid by the Portuguese State to IMF for the loan obtained from troika will fall 32% in 2018. Costs decreased because of this year's early repayments.

The early repayments to the International Monetary Fund (IMF) that Portugal should conclude by the end of this year will enable a decrease of almost one third of the spread demanded by the Fund to the Portuguese Republic. After that, in 2018, as the Portuguese Treasury amortizes the debt to IMF, the cost of the loan will fall even further. ECO knows the goal is to free the country from the additional penalty on the loan in the upcoming year.

The Finance minister Mário Centeno has once again increased the early repayments to IMF, rising to 9.4 billion euros in just one year. This rush in paying IMF is justified by two reasons: first, because interests charged for IMF’s loan are higher than those Portugal is currently able to get in the market. Secondly, because interests charged by the debt left unpaid to IMF also decrease. Portugal pays a surcharge on the amount of debt surpassing the limit from their share, so by making an early amortization of around nine billion euros, the average spread demanded by the Portuguese Treasury decreases considerably.

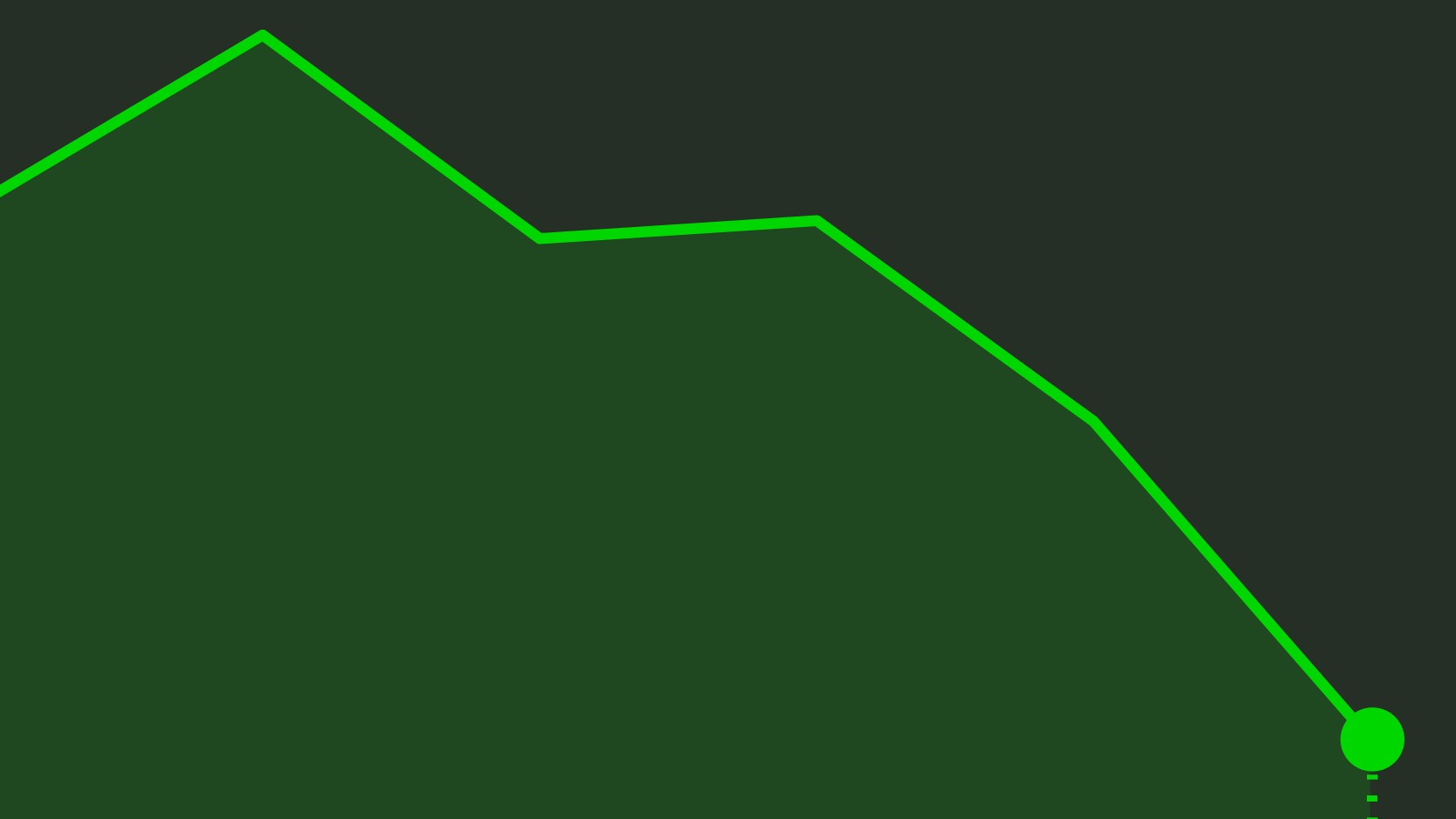

The next chart shows the Portuguese position in comparison to the Fund, on December 31, 2016, in euros and SDR (Special Drawing Right), IMF’s coin. It also shows this year’s projected position, considering the number of announced repayments for the end of the year.

Debt to IMF: 2016 vs. 2017

Yet, IMF’s debt does not all cost the same. As IMF told ECO, the financing line used by Portugal on the loan states the rate is set weekly: right now, the reference interest stands at 1.675%.

To this amount, a 100 basis points’ spread can be added. But this spread is worsened for high debts in comparison to the countries’ share in IMF. If an amount of debt surpasses this limit, a 200 basis points’ spread is added, and if that limit is surpassed for longer than 51 months, the spread increases to 300 basis points. The limit is set as 187.5% of the country’s share.

As for Portugal, the threshold corresponds to 3.86 billion SDR (around 4.7 billion euros) and since debt continues standing above that threshold for more than 51 months, the debt’s spread is 300 basis points.

What changes with the early repayments?

On December 31, 2016, Portugal owed 16,327 million euros to IMF (around 13.5 billion SDR). The average spread demanded by IMF for the total amount of debt was 243 basis points. Yet, with the early reimbursements, the Portuguese debt parcel to which the surcharge is applied decreases greatly. Assuming the Government follows through with the announced reimbursements until the end of the year, totaling 9.4 billion euros, IMF’s debt falls to 6,927 million euros (around 5.7 billion SDR).

All in all, the average surcharge should decrease 165 basis points, 32% less in comparison to the beginning of 2017. Assuming the 1.675% interest, it implies decreasing the 4.105% interest rate to 3.325%.

What part of the debt pays the surcharge?

In order not to be penalized, Portugal has to amortize another 2.8 billion euros to IMF. Officially, a 1.4 billion euros’ amortization is planned for 2018, but the Government’s goal is to maintain the strategy of accelerating the payment to funds, as was the case this year. ECO knows that the expectation is to be able to achieve the right threshold next year in order to stop paying the surcharge.