Central bank recommends ‘consideration’ from ECB members

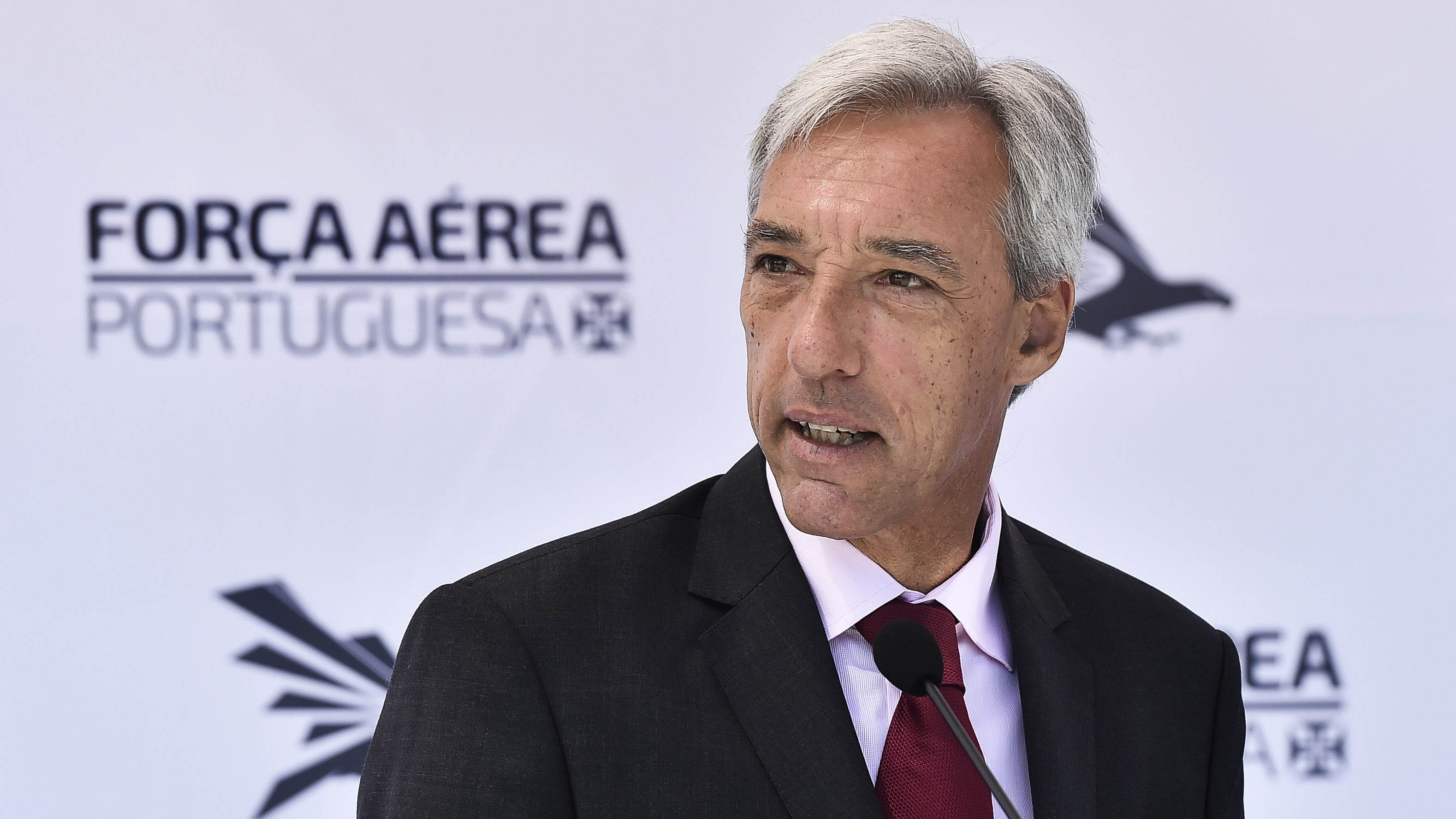

The Governor Mário Centeno recommended "calm" and "consideration" to members of the Governing Council of ECB on statements about the timing of interest rate hikes.

The governor of the Bank of Portugal on Thursday recommended “calm” and “consideration” to members of the Governing Council of the European Central Bank (ECB) on statements about the timing of interest rate hikes.

At issue are the statements made this week by Isabel Schnabel, a member of the Executive Board of the ECB, that “an increase in rates in July is possible,” and, on the other hand, fellow board member Fabio Panetta said that “it would be imprudent to act without first knowing the GDP figures for the second quarter and discussing other measures.

Asked about the issue, during the conference presenting the May Economic Bulletin today at the Museu do Dinheiro in Lisbon, the governor of the Bank of Portugal said that “when the ECB says it acts dependent or in a way linked to the data this is true”.

“And unless any of those members of the Board of Governors have access to data that is not yet disclosed, I would recommend some calm and thoughtfulness in those communications,” he said.

Mário Centeno stressed: “Either we are dependent on data”, or there is “access to information that is not available by all, and there is an asymmetry here”.

The governor of the BdP added that the ECB “has been extremely successful in the way it has managed its monetary policy”, stressing that a “very clear statement has been made towards the normalisation of monetary policy”, that is, towards a more neutral position regarding the stimuli that were considered important to respond to the impact of the pandemic, ensuring that “this path will certainly be followed”.

Mário Centeno stated that raising rates in the euro area and normalising monetary policy “is very important and will happen” and that “any move in this direction is desirable”, but he stressed that “it will only be taken when it is safe to do so”.

Asked about a stagnation scenario in the eurozone, he acknowledged that “it is in the spectrum of possible scenarios,” as it is included in the ECB’s adverse scenario, published in March.

The head of the central bank also stressed that the situation in the euro area was very different from that in the United States, where the US Federal Reserve (Fed) announced on Wednesday a 50 basis point increase in the key interest rate range.