CTT maintains dividend policy and aims for “Iberian leadership” by 2028

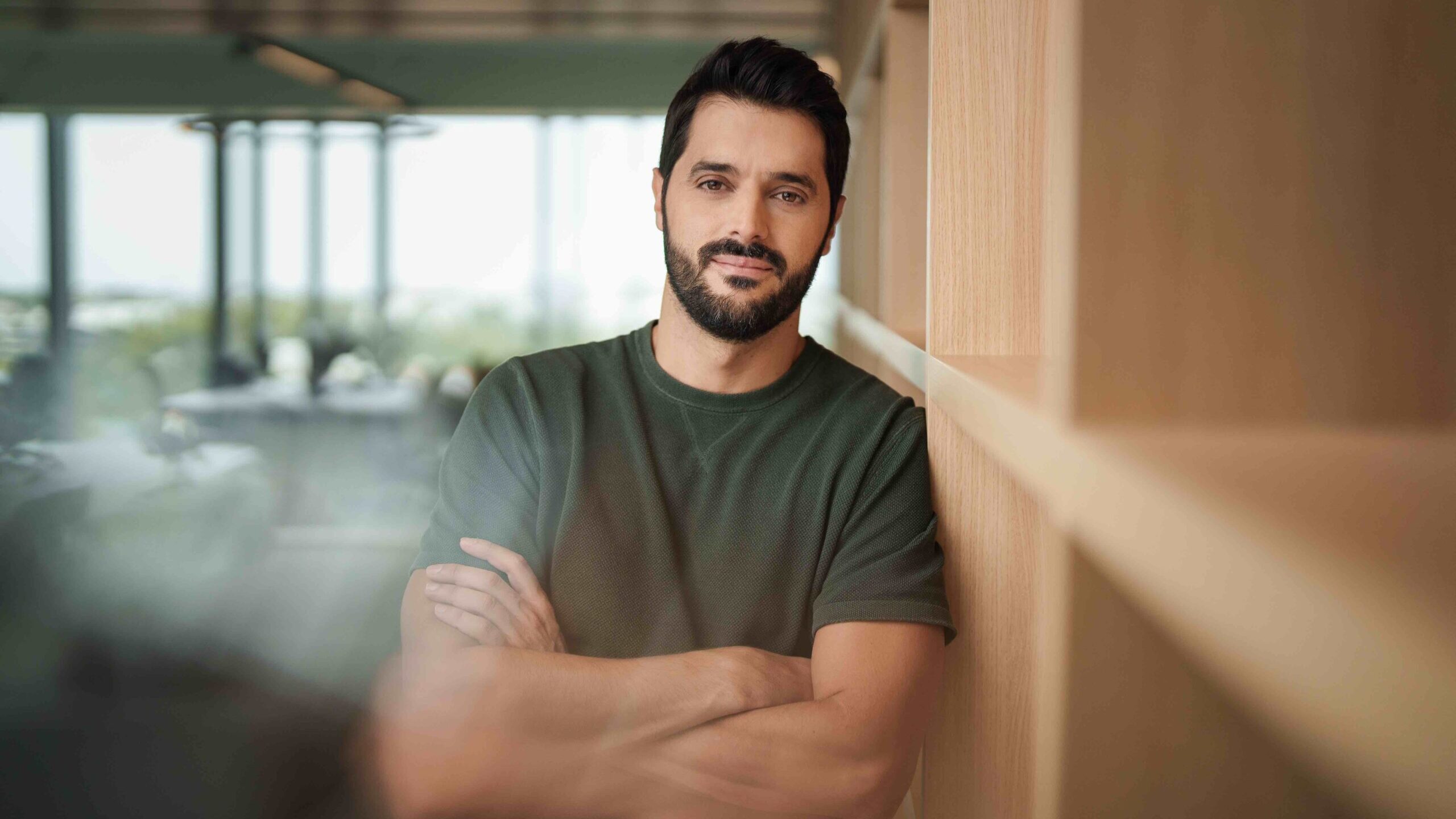

The group led by João Bento promises to achieve "Iberian leadership in e-commerce logistics" over the next three years, during a period in which it will "intensify" investment.

On Tuesday, CTT presented a strategy to become “market leaders in the Iberian Peninsula” in the logistics and e-commerce sector by 2028, with the fundamental help of the “planned partnership” with DHL in the consumer and business segments, which still requires regulatory approval.

The company also indicated that it will “simplify” and “streamline” its reporting of results starting this year, with e-commerce becoming its main business and postal services, historically the core of this century-old group, definitively pushed into the background.

On the day it promotes a Capital Markets Day — which CEO João Bento predicted would be “glorious” — CTT reiterates its guidance for this year and expects to achieve operating income of between €1.6 billion and €1.7 billion by the end of 2028 and EBIT of between €170 million and €195 million. This is an increase on the revenues of between €1.1 billion and €1.25 billion that the group expects to achieve in the 2025 financial year and the recurring EBIT of €115 million, which already includes the positive impact of the purchase of the Spanish company Cacesa over an eight-month period.

However, the growth anticipated for this three-year period is lower than what CTT had forecast for the period from 2023 to 2025. The compound annual growth rate (CAGR) of 7% to 9% forecast for 2028 in terms of revenue and 13% to 17% in terms of EBIT is lower than the 7% to 10% and 14% to 19% forecast for 2025 when CTT held its Capital Markets Day in 2022.

In terms of shareholder remuneration, over the next three years, the company plans to maintain its “target of paying between 35% and 50% of net income in recurring dividends”, in line with what has happened since the last Capital Markets Day in the summer of 2022.

“To achieve the growth forecast for the period 2026-28, CTT will intensify its core investment during this period”, the company says. Over the three-year period, capex will reach €50-55 million per year, “which is equivalent to an intensity, as a percentage of revenue, of around 3.5% to 4%”. This investment will be used to increase capacity across the Iberian Peninsula, expand the network of lockers and improve the customer experience on digital channels.

Banco CTT on track to reach one million accounts

With regard to Banco CTT, the group aims to reach one million accounts in the next three years, increase turnover to between €12 million and €14 million, significantly boost pre-tax profits to almost double the €26 million achieved in 2024, and maintain a self-financed investment plan with 100% of earnings reinvested.

“With regard to Banco CTT, the focus is on catalysing the next cycle of growth by focusing on three areas of growth: increasing the customer base and level of engagement, standing out in savings and fighting for a fair share of credit”, adds the statement submitted to the Portuguese Securities Market Commission (CMVM) minutes before the opening of the stock markets in Europe.

Still regarding the bank, the company did not disclose any news about the future of Banco CTT’s shareholder structure, which remains partially owned by CTT together with Generali Tranquilidade, which holds 8.71% of the capital.

In February, in an interview with ECO, the CEO of CTT anticipated, referring to this Capital Markets Day, that the group would “probably” take advantage of the occasion to “continue to affirm this idea that, in general, the importance of the bank” in CTT’s portfolio “will decrease”.

However, in a speech to financial analysts on Tuesday morning, João Bento said that CTT’s portfolio “is now well balanced”.

Group adopts “new reporting structure”

In addition to these guidelines for the three-year period, CTT announced a “new reporting structure” starting with the 2025 annual results, which will be “simplified and streamlined” from the company’s perspective. Thus, from now on, the company will disclose “only three business areas” to the market:

- ‘E-commerce solutions’, which includes the activities of CTT Expresso in Portugal and Spain (‘corresponding to the scope of the transaction with DHL’) and Cacesa. In 2024, this segment represented revenues of 584 million and EBIT of 54 million (adjusted for the full consolidation of Cacesa).

- ‘Post and Services’, which covers “the former segments of ‘Post and Others’ and ‘Financial Services'” and other Express and Parcel businesses not covered by the partnership with DHL, such as Decopharma, Fundo 1520 and the business in Mozambique. In 2024, this segment represented revenues of 509 million and EBIT of 22 million.

- Banco CTT, which “corresponds to the consolidation perimeter” of the bank majority-owned by the group and which “remains unchanged’”. In 2024, revenues were 130 million and recurring EBIT was 27 million.

The “journey” towards “leadership”

On what is probably the most important day for the CTT group from a financial markets perspective — the two most recent Capital Markets Days were in 2022 and 2015 — the company has announced to investors its ambition to become the market leader in the Iberian Peninsula. And the path to get there is clear.

Already considering the new internal organisation, and starting with E-commerce Services, where they hope to be leaders, CTT promises to “evolve” the operational model, “combining a complete last-mile offering with a broader presence in the value chain to foster customer loyalty”, according to the presentation submitted on Tuesday to the CMVM.

In Mail and Services, CTT intends to “stabilise the mail”, “stimulate business solutions” and “strengthen retail”. “To achieve these objectives, CTT will leverage mail prices as it prepares for the next universal service contract and will reduce costs through operational efficiencies, capitalising on current commercial and network capabilities” in the business and consumer segments.

For Banco CTT, the goal is to “accelerate growth and profitability”. “To achieve these aspirations, Banco CTT will strengthen a distinctive business model, complete its offering and drive digital to combine a non-replicable physical presence”.

The company hopes to facilitate this strategy in three ways: developing more technology and engineering internally, focusing on “attracting, developing and rewarding talent” and, finally, “integrating sustainability into daily and routine decisions and actions”.

CTT shares opened down 0.7% at €7.08, minutes after this information was released, in a negative session for most European stock markets. In the previous session, shares fell more than 5.5%. Throughout the morning, CEO João Bento and other senior executives of the listed company are expected to make statements.