Platform: Banking wants NPL to be quickly removed from the bank’s balance

Banks want companies included in the NPL platform to be able to quickly lose that "stamp" in order to be able to start receiving financing again.

The platform to reduce non-performing loans (NPL) is a positive step, but there is another issue to be solved: companies with defaulted loans must quickly loose that “stamp” in order for banks to be able to grant credit. This is the idea shared by CGD, Novo Banco and BCP, the three banks that are taking part in this platform. More news about this solution? Only next year.

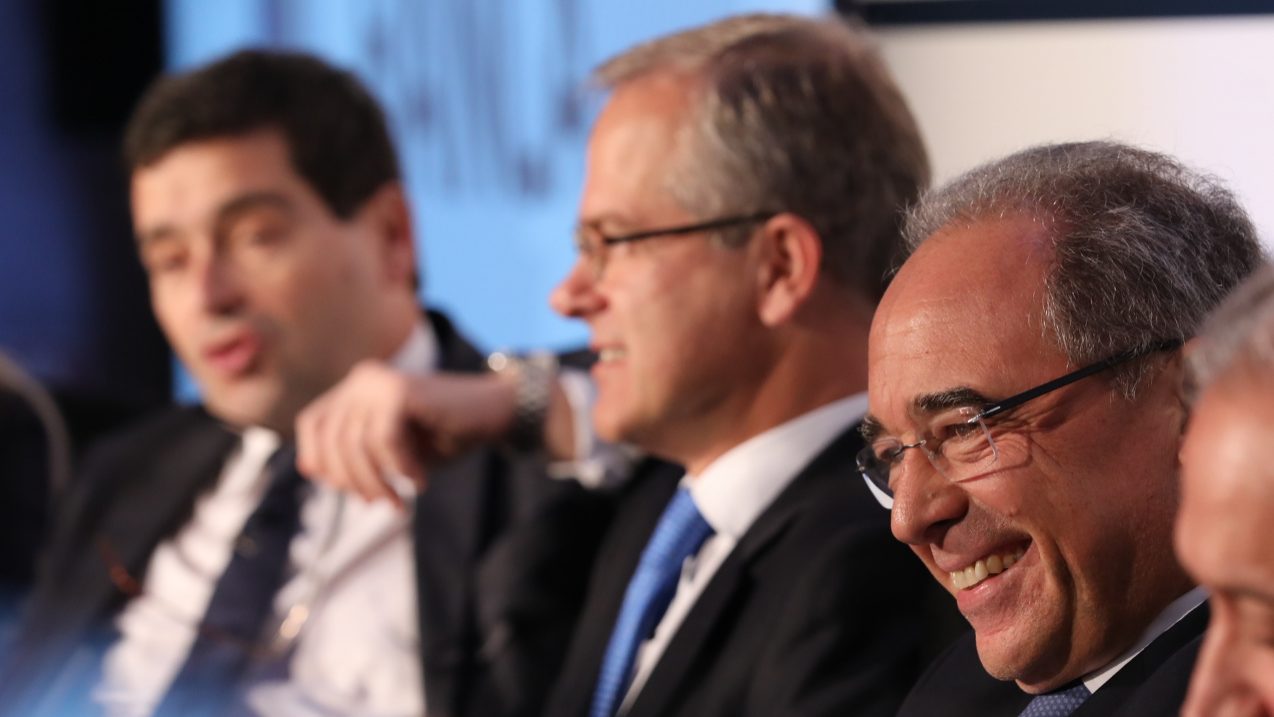

BCP’s president is optimistic about the platform to clear NPL, since it will “be a support to the joint regeneration of a set of companies”, Nuno Amado stated in Fórum Banca, promoted by Jornal de Negócios and PwC. Yet, in order to have the desired effect, there is one problem that needs to be solved: these companies “have a stamp”, which makes credit granting more difficult, Nuno Amado stated.

However, how quickly these companies lose their stamp depends on the bank headed by Mario Draghi. It is necessary that the European Central Bank (ECB) validates these changes with the purpose of quickly stopping these restructuring processes from being considered defaulted loans. This can be done by removing the label that continues making those loans weight in on banks’ ratios, which will make it easier for banks to be able to find lasting solutions for these companies.

The Platform for the Management of Banking Credits (ACE) will be created very soon. CGD, BCP and Novo Banco have signed a memorandum of understanding to put this mechanism at work. “We will have more news next year”, Paulo Macedo, from CGD, stated in Fórum Banca.