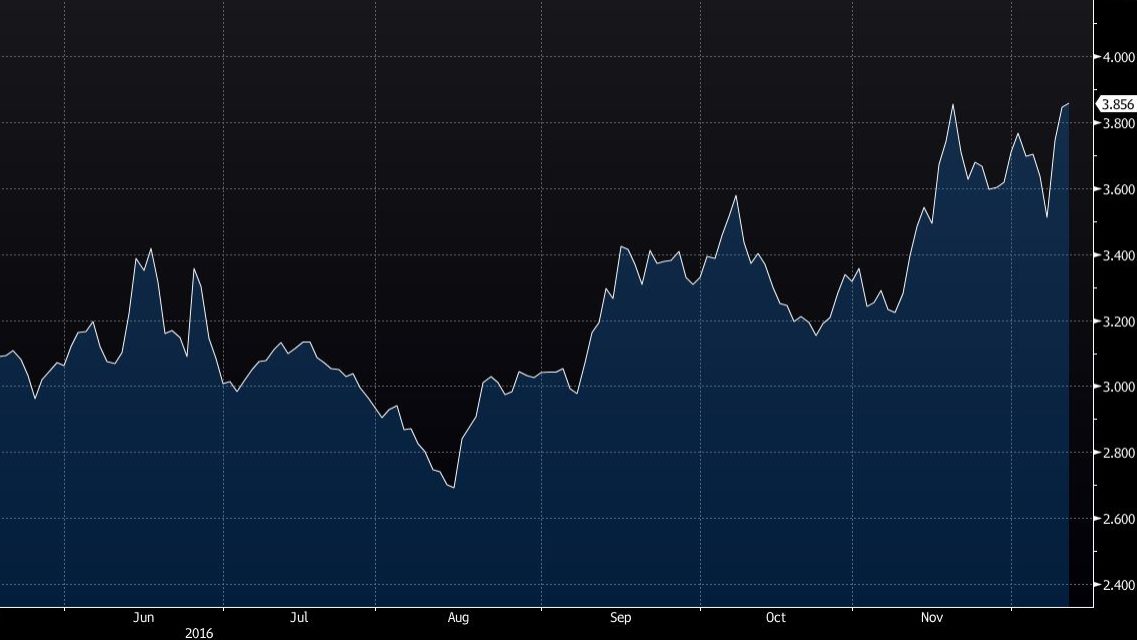

Portuguese debt interests surpass 4%

After suffering an increase of over 10 points, the ten-year Portuguese bond rate surpasses the 4% limit, which hadn’t happened since February 2016.

Pressure. Portuguese ten-year debt interests surpassed today the 4% threshold. The rate increased more than ten basis points to 4.014%, the highest percentage registered since last February, which was the percentage the rating agency DBRS had identified as “uncomfortable”.

Interests increase in the majority of maturities, during the market’s anticipation of a debt auction for the next couple of days. This expectation comes from the Portuguese Treasury history records: since 2014, the Institute for Public Credit Management (IGCP) has organized bonds auctions on the beginning of the year. As for five-year bonds, the yield increased more than seven basis points to 1.957%.

Aside from predicting a larger offer of bonds in the market, Euro Area debt interests have been augmenting following the continent’s inflation which surpassed analysts’ expectations.